Introduction

If you’re starting your journey into the stock market, you’ve probably come across several technical tools, systems, and indicators that promise profitable outcomes. Some are simple to understand and follow, while others can be complex and overwhelming for beginners. In this post, we’ll cover one powerful yet beginner-friendly indicator: Anchored VWAP. It’s easy to understand and use, but also one of the most powerful tools in your trading or investing arsenal. It can be applied to both short-term trading and long-term investing. What makes it especially effective is that it aligns your strategy with the actions of institutional traders and investors. This guide will help you understand what Anchored VWAP is, why it’s used by professionals, and how you can apply it to improve your probability of profit.

What is VWAP Anyway

Before we get to “Anchored” VWAP, let’s briefly touch on its parent: VWAP (Volume-Weighted Average Price).

Imagine you’re buying snacks for a party. Some are cheap, some are expensive, and you buy different quantities of each. VWAP is like figuring out the average price you paid per snack, but it gives more weight to the snacks you bought more of.

In the stock market, VWAP does the same thing for a stock’s price over a specific period (usually a trading day). It calculates the average price at which a stock has traded, taking into account the volume (how many shares were traded) at each price level. So, if a lot of shares were traded at $10, that $10 price will have a bigger impact on the VWAP than a price where only a few shares were traded. In other words, VWAP is a reflection of demand at a particular price.

Why is VWAP useful? It helps traders see a “fair” average price for the day, and many professional traders use it as a benchmark. As institutional investors and smart money drives the market and generates maximum volume, VWAP is a way to understand where the smart money has traded.

What is Anchored VWAP?

The “Anchored” in Anchored VWAP means you get to choose your starting point. Instead of just calculating the average price for today, you can tell the VWAP to start its calculation from any significant event or point in time you choose.

Think of it like this: If regular VWAP is calculating the average price of your snacks today, Anchored VWAP allows you to calculate the average price of your snacks since you started planning the party, or since that big sale happened last week.

Why is this a game-changer? Because major events in a stock’s life often influence how investors perceive its value going forward. By anchoring your VWAP to these events, you can see how the stock’s current price compares to the average price paid by all investors since that key moment

Why Institutions Love Anchored VWAP ?

This is where the true power of this indicator lies. While individual traders like us use AVWAP to gain an edge, it’s an even more critical tool for institutional investors – think large mutual funds, hedge funds, and pension funds. Here’s why:

- Execution Benchmark: Imagine a fund manager needs to buy millions of shares of a particular stock. If they just bought them all at once, their large order could significantly push the price up, leading to a worse average price for them. Instead, they use algorithms that aim to execute their orders at or better than the VWAP (or Anchored VWAP). It’s a key metric to gauge how efficiently their traders are getting in and out of positions without disrupting the market too much. If they’re constantly buying above the VWAP, it means their execution isn’t optimal.

- Tracking “Smart Money”: Institutional money moves markets. When a big fund starts accumulating or distributing shares, it leaves a footprint. By anchoring VWAP to significant points (like a major earnings report, a new CEO announcement, or a big product launch, major swing high or swing low), institutions (and smart retail traders!) can observe where the “average” cost basis of other large players might be. If the price is consistently holding above an Anchored VWAP from a major positive event, it suggests that the large money that entered around that event is still profitable and holding, indicating conviction.

- Identifying True Support and Resistance: Forget arbitrary lines on a chart! When a stock’s price consistently interacts with an Anchored VWAP line, bouncing off it as support or rejecting it as resistance, it’s often because institutional algorithms are reacting to that level. Since AVWAP incorporates volume, it represents an average price where significant capital has been committed. These levels become self-fulfilling prophecies to some extent, as institutions program their systems to react to them.

- Long-Term Trend Analysis: Unlike the daily reset of regular VWAP, Anchored VWAP allows institutions to track the “fair value” of a stock over weeks, months, or even years, from a specific impactful event. This helps them understand the long-term sentiment and average conviction of the market since that event, providing a powerful backdrop for their investment decisions

Why Traders Use Anchored VWAP

Anchored VWAP offers several advantages:

- Identifies Support and Resistance Levels: Anchored VWAP acts as dynamic support (floor) or resistance (ceiling) levels, providing traders clear areas to watch for potential price reactions.

- Market Sentiment: Helps gauge whether the majority of traders are winning or losing since a significant event, providing insights into market sentiment.

- Entry and Exit Signals: Traders often use it to determine optimal entry and exit points, based on how price reacts around the anchored VWAP line.

How to Choose Anchor Points for Plotting Anchored VWAP?

Anchoring VWAP correctly can significantly improve your trading strategies. Here’s how you can anchor VWAP for various trading approaches:

1. Long-Term Investing

- Significant Market Events: Anchor VWAP at major market lows or highs, such as bear market bottoms or bull market peaks (like Jun’24 low and Sep’24 high recently). This approach helps investors understand overall market sentiment over extended periods.

- Key Company Events: Anchor to fundamental events like earnings reports, major product launches, or critical regulatory approvals. This reveals investor sentiment regarding company-specific developments.

2. Swing Trading

- Recent Highs or Lows: Anchor at the most recent significant highs or lows to track short to medium-term sentiment shifts.

- Trend Changes: When a stock breaks out of a long-term range or initiates a new trend, anchor VWAP to the breakout point to assess the strength and validity of the new move.

- Gap-Up or Gap-Down Events: Anchor at points of price gaps created by earnings or news-driven events to evaluate potential continuation or reversal opportunities.

3. Day Trading

- Opening Session: Anchor VWAP at the opening price of the trading session to gauge intraday sentiment and momentum.

- Intraday High/Low: Anchor VWAP at intraday highs or lows to capture intraday sentiment shifts and identify possible entry or exit points within a trading session.

Real-World Example

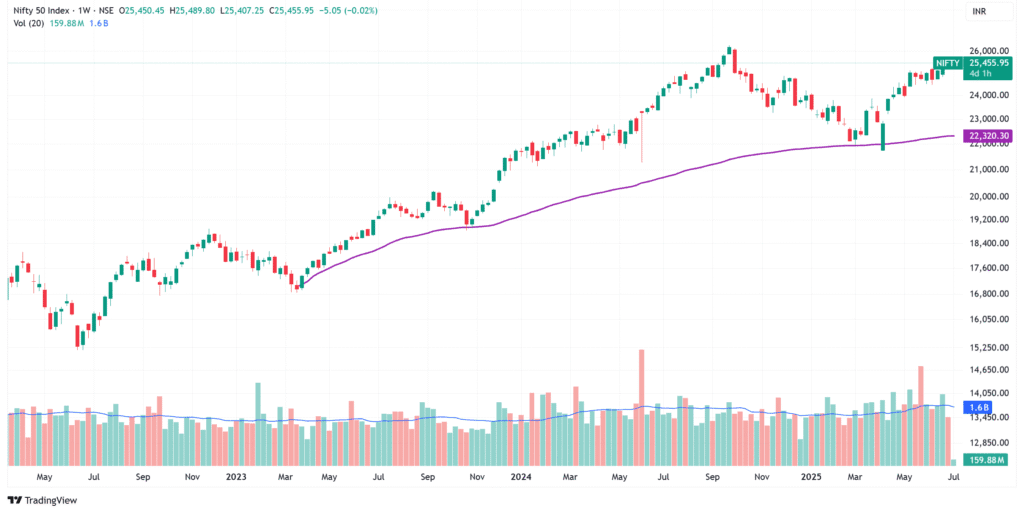

The chart below shows the Nifty 50 on a weekly timeframe, with the Anchored VWAP placed from the March 2023 low — a key turning point where the 2023–24 bull market began, eventually peaking around September 2024.

Notice how well the price has respected the Anchored VWAP lines — first in October 2023, and more recently in March and April 2025. These reactions highlight the relevance of AVWAP as a dynamic support and resistance tool.

We’ll explore more examples and case studies in Part 2 of this topic, where we dive into specific strategies. For now, the key takeaway is this: choosing the right anchor point is the most critical step when using Anchored VWAP. The anchor should align with your trading objective i.e whether you’re swing trading, day trading, or investing. We’ll focus more on long-term investing, using higher timeframe charts in our analysis in part 2 of this blog post.

Conclusion

Anchored VWAP is a powerful yet simple indicator that helps beginner traders understand market sentiment and identify key price levels. By carefully selecting your anchor points based on your specific trading strategy, you can significantly enhance your analysis and decision-making. With practice and careful observation, Anchored VWAP can become an essential tool in your trading toolkit.

While Anchored VWAP is a fantastic tool, and its institutional relevance makes it even more powerful, it’s not magic. It’s one piece of the puzzle in understanding a stock’s behavior. Always use it in conjunction with other analytical tools for better outcomes. It tells you about the average price paid by investors, particularly the big ones, but it doesn’t predict the future with certainty.