What are Index Funds ?

Imagine walking into a lunch buffet. Instead of choosing a single dish, you’re handed a plate that automatically picks a little bit of everything — salads, main courses, even your favorite dessert. You get a balanced, diversified meal without overthinking it.

That’s exactly how index funds work.

When you start thinking about investing, the first question usually is — where do I put my money?

Should you buy stocks like Reliance or HDFC Bank on your own? Or should you go with mutual funds, where a fund manager (imagine a sharp MBA type who’s glued to stock screens all day) picks stocks for you?

Now, if you’re not sure how to pick stocks and honestly, most people aren’t in the beginning, going with mutual funds is a good start. But here’s the tricky part, even picking the right mutual fund isn’t easy. Not all fund managers get it right all the time, and what worked last year might not work next year.

That’s where index funds come in. They don’t try to beat the market, they become the market. No guesswork, no stock-picking stress.

Just pick a few solid index funds (don’t worry, I’ll share which ones later), invest a bit from your monthly savings, and let your money do its thing quietly in the background.

Why Lazy Investing is Rewarding ?

- Ultra Low Fees: Direct-plan Nifty index funds charge ~0.10 % a year; active funds often charge 1–2 %. Every saved rupee stays in your compounding machine.

- Built-In Diversification: You invest in 50+ companies diversified across IT, banking, FMCG, energy. If one sector tanks, Others can cushion the blow. Your money stays invested and keeps working for you

- Performance: Research shows more than 80% fund manager fails to beat the benchmark index over long term. By being lazy, you are in top 20% with minimal effort

- Peace of Mind: No tracking headache, governance issue with fund houses and so on.

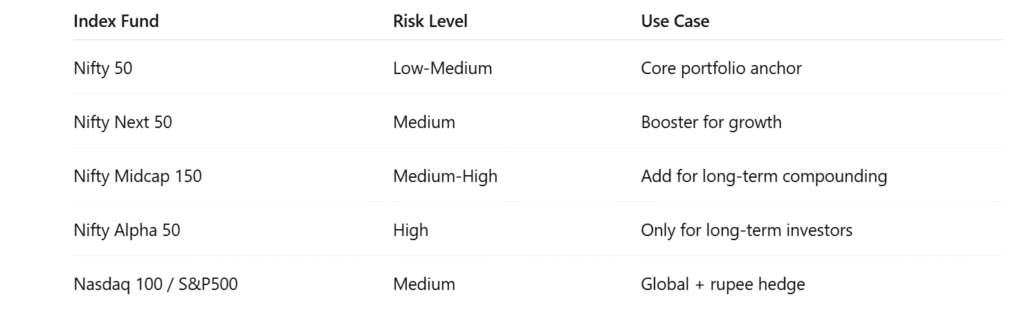

Choosing Index Funds: Which Ones Should You Bet On ?

- Nifty 50 (or Sensex 30): This is your Virat Kohli and absolute must in your portfolio. Nifty 50 is a basket of India’s top 50 companies and gives you exposure to India’s biggest and most established companies. This should be your core portfolio holding, stable but still offering growth

- Nifty Next 50 is like the waiting bench for future blue chips. It has more potential upside than Nifty 50, but also comes with a bit more volatility.

- Nifty Midcap 150 focuses on mid-sized companies with high growth potential. The rewards can be bigger — but so can the swings. Consider adding this once your core portfolio is in place.

- Nifty ALPHA 50: This is slightly diversified basket which is mix of large, mid and small companies. Just like Midcap150, this is very volatile but offers great potential to compound capital. We have covered this fund in our another article on passive investing. This is suitable for investor with really long term horizon (say 10-15 years or more). If you invest in this index fund over 2-3 cycles, this can be real wealth creator.

S&P 500 or Nasdaq 100 take you global. You’re buying into companies like Apple, Microsoft, and Amazon. These also act as a good rupee hedge while adding international flavor to your portfolio.

The table below provides a quick summary of what we just mentioned. Use this as a cheat sheet to build your own mix based on your goals and comfort with risk.

How to start ?

Follow the below 3 steps to start your journey and you are all set for stupendous wealth creation.

- Decide the Amount – Commit, say, ₹5,000 a month (10 % of a ₹50k salary). 10% of take home salary is generally a good starting point

- Pick a Date: Choose a SIP date, ideally 2–4 days after payday so your account is funded.

- Enable Auto-Increase: Most platforms let you bump SIP by 5 % yearly; match your salary hikes and inflation.

That’s all. you are all set for your wealth journey.

Busting Myths and Fears

- Index funds are boring: Boring is nice, boring is profitable. The goal is wealth, not excitement. This is your hard earned money, if you do not have experience, you need to stick to low risk ways of growing money

- What if markets crash right after I invest?: Market correction or crashes are like those annual sales for young investors. Your next SIP buys more units cheap. Over decades, crashes are blips on an upward slope. You accumulate more units, and over time, as the market hits new highs, your capital grows

- Active funds can still win. Certainly they can and they have. But identifying the one who will do well for next 20 years is a challenge for beginners. You can hire an investment advisor like us who can do all this for you.

Guardrails to Keep Your Lazy Strategy on Track

Stay Allocated – Don’t pause SIPs unless income stops.

Rebalance – Once a year, nudge back to your chosen mix (e.g., 80 % equity, 20 % debt).

Add a Debt Counterpart – As you age, add other assets like gold or bond fund or PPF smooths the ride and offers funds for near-term goals.

Upgrade Knowledge Gradually – Investing in yourself has the best long term returns. As you learn, you can take more calculated risk, make sensible decision during periods of volatility

Final Takeaway

Index investing is like taking the metro instead of driving through city traffic. It may feel slower day to day, but you arrive on time, stress-free, and with more cash in your wallet. Nail this lazy-genius habit in your 20s, to truly enjoy your 40s. If you are looking for customized portfolio or ready to invest, high performance mutual fund portfolio, .feel free to reach out for a personalized investment plan or check out our ready-to-invest mutual fund portfolios