Introduction

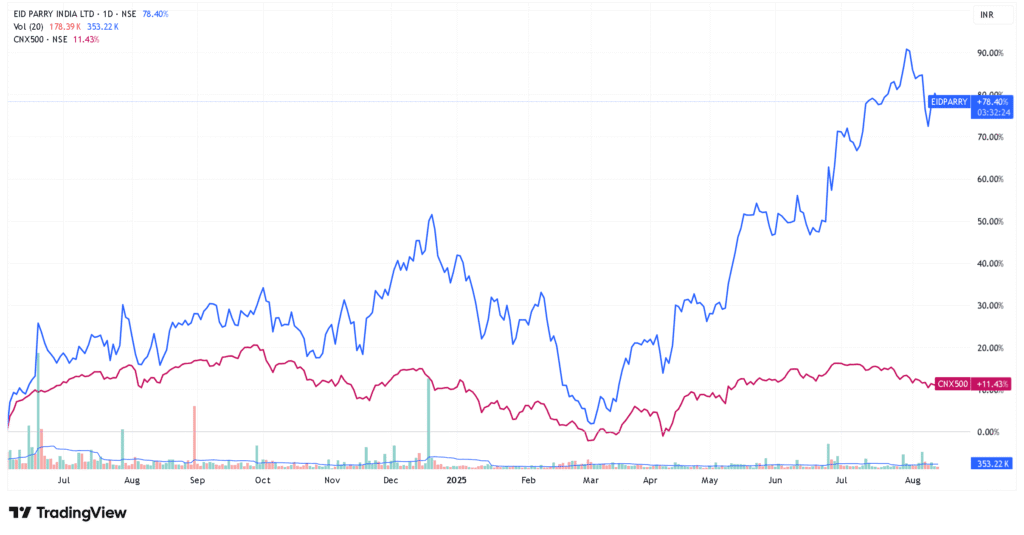

EID Parry is a leading Indian sugar and allied products company (part of the Murugappa Group) with diversified operations spanning sugar, ethanol/distillery, co‐generation, farm inputs (fertilizers), nutraceuticals and branded consumer staples. Its 56.4% stake in fertilizer maker Coromandel International provides additional value and earnings stability. The stock is in strong uptrend and has delivered ~49% return in last 1 year compared to Nifty 500 return of -0.3%. The stock has significantly outperformed the benchmark and in this post, we looked at its financial and valuation and estimate upside potential using SOTP valuation.

Business Overview

History & Corporate Structure: Founded in 1842, EID Parry is one of India’s oldest sugar companies. It is headquartered in Chennai and is part of the Murugappa conglomerate. The company’s consolidated operations include sugar manufacturing, distilleries, co-generation power and allied products, plus newer ventures in nutrition and branded products.

Core Segments: The sugar division (Parrys Sugar) operates multiple sugar mills in Tamil Nadu and Karnataka. The ethanol/distillery segment has rapidly expanded (current capacity ~582 KLPD) to capitalize on India’s blending mandate. The co-generation segment sells surplus power to the grid. The farm inputs division distributes fertilisers and crop nutrients (leveraging Coromandel’s distribution network). The nutraceuticals unit (Parry Agrosciences US) produces organic supplements (e.g. spirulina) for exports. The consumer products group (launched 2022) markets branded “Staples” (rice, dals, etc.) and sweeteners.

Subsidiaries & Investments: Key consolidated subsidiaries include Parrys Sugar Industries (Ghana) and US Nutraceuticals Inc. Importantly, EID Parry holds a controlling stake in Coromandel International (fertilizer/chemicals, listed). It also owns 65% of Parrys Sugar (London) and had joint ventures (e.g. Algavista for biopesticides). Recent strategic moves include the launch of new branded products, expansion of distillery capacity (with Chinese technology) and investment in EU-approved nutraceutical exports.

Financial Analysis:

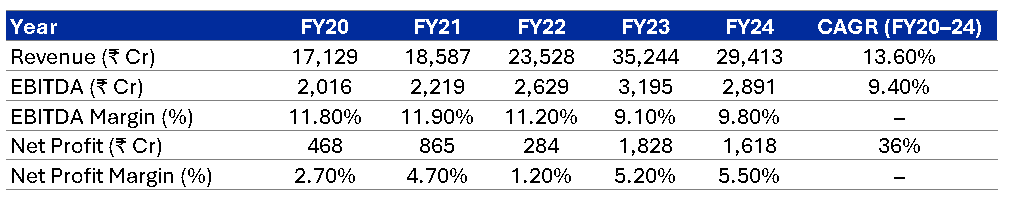

Revenue & Earnings Growth: Over FY20–24, consolidated revenue grew from ₹17,129 Cr to ₹29,413 Cr (CAGR ~13.6%). The sharp rise in FY23 (+50%) was largely due to a fertilizer price boom and ethanol sales; FY24 saw a correction with a 17% decline to ₹29,413 Cr as commodity prices normalized. EBITDA rose from ₹2,016 Cr (FY20) to ₹2,891 Cr (FY24), with a dip in margin to ~9.8% in FY24. PAT was volatile: FY21 included a one-off profit from the Coromandel stake sale (PAT ₹865 Cr), whereas normalized PAT in FY22 was only ₹284 Cr. PAT recovered to ₹1,618 Cr in FY24.

Balance Sheet & Leverage: EID Parry maintains a very strong balance sheet. As of Mar’24, consolidated debt was only ₹294 Cr (vs. ₹814 Cr a year earlier), implying very low leverage on a ₹10,000+ Cr net worth base. The company used Coromandel stake sale proceeds to pay down debt. Net debt was negligible at Mar’24. Interest coverage remains high (FY22 interest cover ~11.5x) due to healthy EBITDA. The company has ample working capital lines; gearing (debt/equity) is under 0.1x. Current ratio and quick ratio are typically above 1.2x. Overall liquidity is ample.

Cash Flow: EID generates healthy operating cash flows, though they are lumpy with agricultural cycles. Operating cash flow was ₹367 Cr in FY22. However, capital expenditures are significant due to new distillery and plant expansions (FY23 capex ~₹239 Cr, FY22 ~₹166 Cr). Free cash flow has been modest (CFO minus capex), as the company invests heavily in growth. Nevertheless, cash accruals and stake sales have kept net debt low.

Q1 FY26 Financial Performance (April–June 2025)

EID Parry delivered a strong start to FY26, driven by its fertilizer subsidiary and improving efficiency in core operations. Consolidated revenue grew 29% YoY to ₹8,724 crore, while EBITDA jumped 70% YoY to ₹895 crore (EBITDA margin ~10.3%, up ~2.5ppt YoY). Consolidated profit after tax (post minority interest) surged to ₹246 crore, up 169.7% YoY, supported by robust earnings in the farm inputs segment. Key segment highlights:

Sugar (including refinery): Revenue of ₹347 crore (–14% YoY) due to lower domestic release quotas, with a ₹49 crore loss, narrower than the ₹59 crore loss a year ago. Higher cane crushing (2.11 LMT vs 1.93 LMT in Q1 FY25) and better realization helped offset lower sugar recovery rates and higher cane costs.

Distillery (Ethanol): Revenue grew 12% YoY to ₹296 crore, benefiting from expanded capacity utilization, and segment profit improved to ₹20 crore (vs ₹13 crore in Q1 FY25) on higher ethanol volumes and cost optimization. The ethanol blending rate reached ~19% by June 2025 (nearing the 20% target for 2025-26), reflecting strong demand and EID’s greater sugar diversion to ethanol.

Farm Inputs (Coromandel): Fertilizer and crop protection operations drove ₹741 crore PBIT (+50% YoY). Coromandel International (56.4% owned) posted ₹7,083 crore standalone revenue (+49% YoY) and ₹508 crore PAT (+54% YoY), aided by strong agri-input demand, 31% higher fertilizer volumes, and a 75% jump in crop protection profit. This robust performance lifted EID’s consolidated results significantly.

Consumer Products (Branded): The CPG division (retail sugar & staples) saw revenue drop to ₹192 crore (–11% YoY) as regulated sugar releases constrained sales, partly offset by a 33% YoY growth in the staples segment (higher sales of premium food staples)

Nutraceuticals: Revenue declined 29% YoY to ₹5.9 crore, but cost controls limited the segment loss to ₹0.2 crore (vs ₹0.26 crore loss a year ago). Nutraceuticals remain a small part of the portfolio.

Bottom-line: Consolidated PAT more than doubled YoY to ₹464.5 crore on a pre-minority basis (₹246 crore attributable to EID shareholders post minority interest). This reflects a sharp turnaround driven by Coromandel’s earnings and improved operating margins. EID Parry’s standalone operations (sugar, ethanol, etc., excluding Coromandel) remained in a net loss, but losses narrowed (₹28 crore net loss vs ₹79 crore loss in Q1 last year) as ethanol profits and cost optimizations partly offset sugar segment weakness

Management Commentary & Outlook

Sugar/Ethanol: Management highlighted that sugar sales were curtailed by lower government release quotas, and recovery rates fell to ~8.0% from 8.6% in the prior year’s quarter, pressuring operational metrics (especially in Tamil Nadu and Karnataka mills). However, higher cane crush and upcoming export opportunities provide optimism. The government’s relaxed ethanol-diversion norms and EID’s distillery expansions (capacity rising from 417 KLPD to 582 KLPD) are expected to boost ethanol output and profitability in FY26. In the earnings call, management noted that only 6 LMT of the 10 LMT sugar export quota was utilized industry-wide (due to high domestic prices), indicating potential export headroom if global prices are favorable. They guided that the resumption of sugar exports and the full benefit of ethanol blending targets (E20 achieved, moving toward E30 by 2030) should support improved realizations ahead.

Farm Inputs: Early monsoon rains led to higher sowings, driving fertilizer demand. Coromandel’s management echoed a strong start to the Kharif season, citing procurement efficiencies and marketing initiatives for the 49% revenue growth. Crop Protection sales were especially strong (31% YoY growth), with 10 new products launched in Q1 and better margins from both domestic and export markets. Coromandel is expanding its agri-retail footprint (70 new stores in Q1, targeting 1,200 stores by year-end) and advancing strategic projects – including new phosphoric/sulphuric acid plants by Q4 FY26 and a 7.5 lakh tone fertilizer plant at Kakinada – to secure raw materials and fuel future growth. This positive outlook for Coromandel bodes well for EID Parry’s consolidated prospects.

Valuation

EID Parry’s value stems from two pieces:

- Core operating businesses (sugar, ethanol/distillery, branded consumer products, and nutraceuticals),

- 56.4% equity stake in Coromandel International Ltd (fertilizers/agri-chemicals).

We value each part separately , then combine them, applying holding-company discounts on the Coromandel stake as required.

- Standalone Business Valuation:

- EV/EBITDA: For the 12 months through Q1 FY26, EID Parry’s core operations generated roughly ₹7,500 crore in revenue and ~₹257 crore in EBITDA. However, profitability has been subdued – the standalone business barely broke even in FY25. Its peers like Balrampur Chini Mills, Dalmia Bharat Sugar, DCM Shriram trades anywhere between 8-15x. Given the promoter group pedigree (Murugappa group), we are assigning 12x EV/EBITDA for its standalone business. At trailing 12M EBITDA of 257 crore, this translates into EV of ~ 3000 crores. Adjusting the net debt of INR 1,000 crores, Market cap of standalone business works out to be ~ 2000 crores (or ~115 per share)

- EV/Sales: EV/revenue multiples for sugar/ethanol companies are typically around 0.8× to 1.0× in India, though they can vary with margins (higher for distillery-heavy businesses, lower for pure sugar commodity producers). Dalmia Sugar, for example, operates at ~1.0× EV/Sales given its strong margins, while some peers are below 1×. EID’s core revenue (TTM ~₹7,500 Cr) includes large low-margin segments (refined sugar exports, etc.), so a somewhat lower multiple (~0.7×) is justified to reflect its weaker margin profile. Applying ~0.7× to ₹7,500 Cr gives an enterprise value of ~₹5,000 Cr. Subtracting ~₹1,000 Cr net debt, we get ~₹4,000 Cr equity value for the core business, i.e. roughly ₹225 per share

For standalone business we are taking average of the 2 method i.e ~ INR 170 per share (average of 115 and 225)

- Coromandel Stake Valuation:

As of today’s closing price, Coromandel International’s market capitalization stands at ~₹70,000 crore. EID Parry’s 56% stake in Coromandel is valued at ~₹40,000 crore, translating to a per-share value of ~₹2,250.

Holding companies typically trade at a discount of 40–60%, depending on the growth outlook of the underlying subsidiary. Given Coromandel’s strong growth prospects, we apply a 40% holding company discount. This values EID Parry’s stake in Coromandel at ~₹1,350 per share.

Based on the above SOTP method, EID Parry’s equity value works out to ~₹1,520 per share, implying ~29% upside from today’s closing price of ~₹1,180. If the holding company discount were to widen to 50%, the SOTP valuation would be ~₹1,295 per share, implying ~10% upside. Future upside will largely depend on Coromandel’s business growth, where the outlook remains robust.

Disclaimer::This research note is issued solely for educational and informational purposes. It does not constitute investment advice or a solicitation to buy, sell or hold any security. Readers should assess their own risk appetite and consult their SEBI‑registered investment advisor before acting on any information herein. Coinstreet and its affiliates may, from time to time, have positions in the securities discussed or may have provided advisory services to clients regarding them. While every effort is made to ensure accuracy, no representation or warranty, express or implied, is given as to the completeness or reliability of the information