1. Introduction

National Securities Depository Ltd (NSDL), India’s first and largest securities depository, has launched its IPO and its open for subscription . The offering is expected to value NSDL at around ₹16,000 crore As a key market infrastructure player, NSDL’s listing is highly anticipated. Here we analyze NSDL’s business model, financials, market position, peers, and investment thesis.

2. Issue Details:

Type: 100% Offer-for-Sale; NSDL receives no proceeds. Proceeds accrue to selling shareholders (IDBI Bank, NSE, SBI, HDFC Bank, Union Bank, SUUTI).

Offer Size: Up to 50,145,001 equity shares (face value ₹2) aggregating ~₹3,811–₹4,011 crore.

Price Band: ₹760–₹800 per share; lot size 18 shares; minimum investment ₹14,400.

Timeline:

Anchor bidding: July 29, 2025

Bid opens: July 30, 2025; closes: August 1, 2025

Allotment: August 4; listing: August 6, 2025.

This OFS fulfills SEBI’s ownership diversification mandate (limiting single-entity stake to 15%), enabling existing promoter banks and NSE to pare holdings while introducing NSDL equity to public markets.

2. Business Overview and Operating Model

NSDL was established in 1996 as India’s first depository to enable electronic holding and transfer of securities replacing physical share certificates. It operates alongside CDSL as one of only two depositories in the country. NSDL’s core function is to hold investors’ securities in digital demat accounts and facilitate trade settlements. Its revenue comes mainly from depository services – account maintenance fees, transaction charges, and custody fees. NSDL has also ventured into ancillary services (such as a payments bank and KYC data management), but these contribute only a small portion of revenue. The depository business remains NSDL’s primary focus and profit engine. NSDL enjoys high operating leverage from its large user base and is subject to strict SEBI oversight. No single shareholder can own more than 15% of the company ensuring it stays widely held and well-governed.

NSDL’s revenue streams (FY25):

Depository Services (Demat account maintenance, transaction fees, corporate actions): ₹6,186 million (43.6% of operating revenue)

Custody & Issuer Services (annual issuer custody fees, DP annual fees): ₹1,936 million (13.7%)

E-governance & Payment Services via subsidiaries NDML and NPBL: remaining balance

Recurring, annuity-style fees account for over 86% of revenues, underpinning predictability and low cyclicality.

3. Market Share and Industry Position

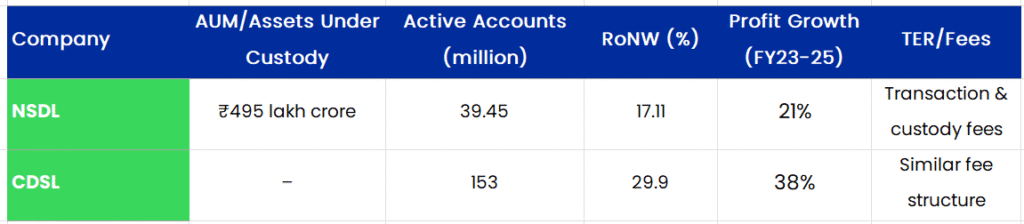

NSDL holds roughly two-thirds of all dematerialized securities by value (about ₹464 trillion as of March 2025). However, in terms of the number of accounts, NSDL has only ~24% share. CDSL – fueled by retail investors – accounts for the remaining ~76%. In other words, NSDL dominates in value of holdings (especially among institutional clients), whereas CDSL leads in the volume of retail accounts.

The depository sector functions as a tightly regulated duopoly. High barriers set by SEBI have prevented any new entrants, and regulations mandate dispersed ownership and strong governance for depositories. This stable industry structure underpins NSDL’s business, though its growth is naturally tied to overall capital market activity and regulatory policies.

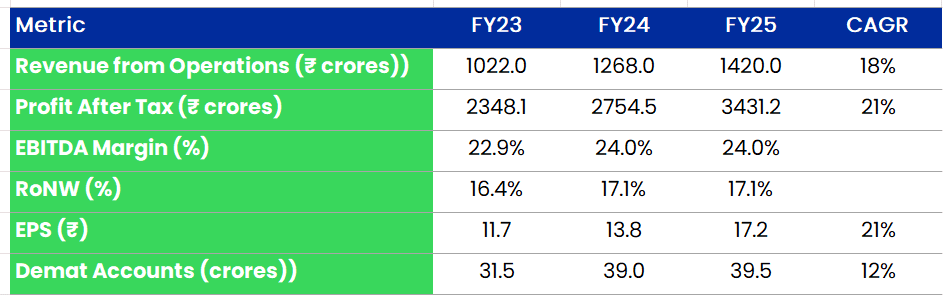

3. Financial Performance

NSDL’s financials have grown steadily. Total income increased from about ₹1,100 crore in FY2021–22 to ₹1,535 crore in FY2024–25. Profit after tax (PAT) rose from approximately ₹234 crore to ₹343 crore in the same period. This implies a 2YR revenue and PAT CAGR of ~18% and 21% respectively. In the same period, CDSL’s revenue and PAT CAGR has ground by 39% and 38% respectively.

This growth was driven by a surge in new demat accounts and higher transaction volumes. NSDL’s net profit margin has been around 20–22% compared to CDSL’s PAT margin of ~49%.. While its margins are a bit lower than CDSL’s (due to NSDL’s broader mix of businesses), the company remains debt-free and financially solid. NSD has strong track record of cash generation and operating cash flow stands at ₹557.85 million in FY25 vs. ₹112.88 million in FY24.

4. Peer Comparison

CDSL is NSDL’s only direct peer. Both depositories provide the same core services, but CDSL is more retail-centric while NSDL has a larger institutional base. In FY2024–25, NSDL’s revenue was higher (~₹1,420 crore vs CDSL’s ₹1,082 crore), but NSDL’s net profit (₹343 crore) was notably lower than CDSL’s (₹526 crore)– reflecting CDSL’s higher margins from a single-focus model. CDSL’s earnings have also grown faster recently thanks to the retail investor wave.

NSDL holds ~20% market share in accounts vs. CDSL’s ~80%. India’s demat penetration stands at 13.4% (FY25), with client accounts projected to grow at ~11–12% CAGR through FY27. As of FY25, CDSL is fundamentally stronger than NSDL on all parameters. As the capital market penetration increases, both NSDL and CDSL are expected to benefit from this.

5. Valuation and Outlook

At the upper band of IPO price , NSDL is being valued at about 46× its FY2025 earnings. This is notably lower than CDSL’s valuation (~66× earnings). While this is at discount to CDSL, note that CDSL is fundamentally stronger than all counts as highlighted above. The discount leaves scope for upside if NSDL can accelerate growth or improve margins post-listing. Grey market premium indicated roughly a 15% expected listing gain for NSDL.

Over the longer term, NSDL’s fortunes will rise with the overall growth of India’s capital markets. As market participation and demat volumes grow, NSDL’s revenues (from account fees and transactions) should increase in tandem. With its entrenched market position, NSDL offers investors a unique proxy for the growth of the Indian financial markets. The key will be how effectively it navigates competition and regulation going forward. Overall, NSDL’s IPO presents an opportunity to invest in a crucial market infrastructure player that has significant long-term growth drivers, balanced against the risks inherent in a regulated duopoly.

6. Risks & Challenges

- Intense Competition: CDSL’s higher retail account growth and discount broker partnerships have eroded NSDL’s share—account base gap: 39.45 million vs. 153 million accounts.

- Technology Dependence: Over 50% of revenues from transaction processing. Prolonged outages, cyber-attacks, or vendor disruptions can trigger regulatory penalties and reputational harm.

- Regulatory & Compliance: Subject to SEBI, RBI, IRDAI and Depositories Act; non-compliance or frequent SEBI observations heighten operational risk

- Concentration of Selling Shareholders: IDBI and NSE divesting sizeable stakes may signal perceived valuation ceiling.

7. Investment Thesis:

Bull Case:

Stable annuity income with predictable cash flows and high barriers to entry.

Untapped rural and Tier II–III market potential boosting demat penetration.

Tax-efficient structure of DP fees supporting net margins.

Bear Case:

CDSL’s dominance among retail and discount brokers may continually constrain NSDL’s growth.

Technological failures or regulatory actions could cause volatility.

Lack of fresh capital limits strategic initiatives and dilutes stock’s appeal as a growth play.

Fundamentally, NSDL is strong and benefits from long term structural tailwind. However, at present, Investors may be better off sticking to CDSL and buying it on declines given its market leadership . Investors should monitor NSDL’s growth trajectory post listing and then decide as from current valuation, there is no meaningful sustained upside left for investors.

8. Conclusion

NSDL’s IPO marks the debut of India’s foundational depository institution on public markets, unlocking value for existing shareholders and introducing retail participation. Its durable revenue model and pivotal role in securities settlement ensure resilience. Yet, competitive pressures from CDSL, technology reliance and absence of fresh proceeds pose strategic constraints. Investors should weigh NSDL’s defensive annuity streams against valuation and execution risks before subscribing.

Disclaimer::This research note is issued solely for educational and informational purposes. It does not constitute investment advice or a solicitation to buy, sell or hold any security. Readers should assess their own risk appetite and consult their SEBI‑registered investment advisor before acting on any information herein. Coinstreet and its affiliates may, from time to time, have positions in the securities discussed or may have provided advisory services to clients regarding them. While every effort is made to ensure accuracy, no representation or warranty, express or implied, is given as to the completeness or reliability of the information.