Introduction – A Stellar 2023 for Equity Investors

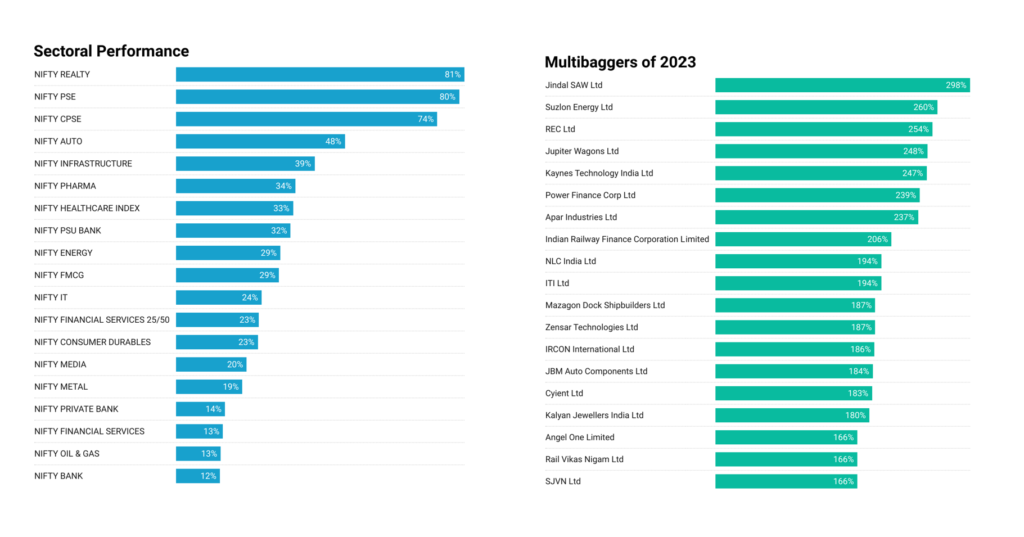

The year 2023 has been a stellar year for equity investors. The market rally specially in small and midcap index that began from mid of Mar’23 is still looking strong . The stocks from many sectors participated in this bull market but the leaders of this bull market was clearly the PSU sector. PSU stocks across the board whether its from defence, railway, shipbuilding, Banks, Power,Infrastructure have delivered multibagger returns. The chart below provides a quick summary of top performing sectors and stocks of CY2023

As we step into 2024, a common question among everyone’s mind is how 2024 is going to be like. While we do not like to predict things but then its that time of a year where we would like to do some crystal ball gazing to anticipate market movements. We will look to evaluate the current situation through multiple lens.

Valuations:

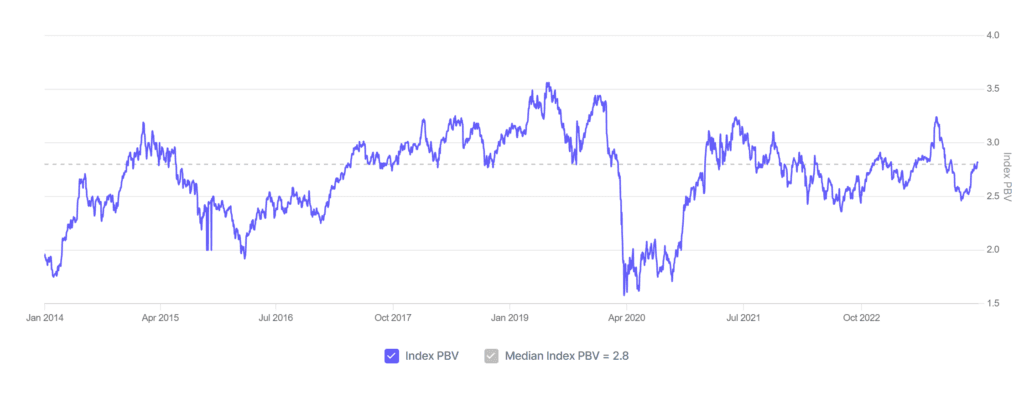

Nifty is currently trading at TTM PE of 23.2x. 10-year median PE of Nifty 50 is around 23.4x. Hence, from valuation perspective, the index appeared to be fairly valued.

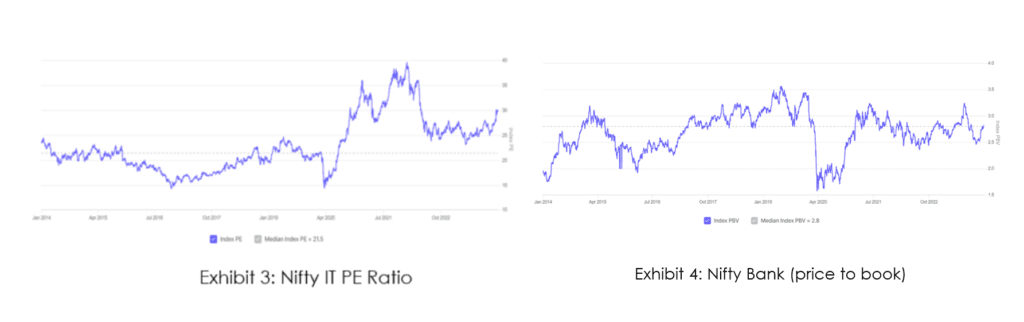

However, we also need to look at key nifty components as they are likely to determine nifty move and the biggest of them is BankNifty and NiftyIT. BankNifty covered some of the lost ground after stellar rally of almost 4000 points in Dec’23. Nifty IT also rallied in Dec’23 after fed meeting and in anticipation of rate cuts in 2024.

BankNifty is currently trading at 2.8x price to book. Its 10 year median PB ratio is around 2.8x. Hence, BankNifty also seems fairly valued and the index move is likely to be earnings driven. Nifty IT currently trading at ~30.0x which is above its median value of 21.5x. If earnings doesn’t follow through we may expect some pullback in Nifty IT. However, the silver lining for the IT index is the likely rate cuts in 2024. Lower interest rates may justify higher multiples.

To conclude, from valuations perspective, the index doesn’t appear overvalued and if there are no major negative surprises in the earnings, Nifty may continue its upward march after some consolidation or pullbacks. Nifty may touch 23000 in CY2024 but before that a pullback to ~20,900-21000 is possible.

Technical Setup

The chart below is the ratio of chart of Nifty w.r.t Nifty Midcap and Nifty Smallcap. Ratio chart of Nifty and Nifty midcap is now at level of Jan’18 when mid and small cap index made its top. Similarly, Small cap index below Jul’21 and marginally above Jan’18 levels.

While its impossible to predict the top in mid and small cap index, a more likely scenario that may play out is out performance of large caps from hereon, something that we have seen during 2018-19 bear market of small and midcap. Further, given the strong rally in mid and small caps that we have seen during CY2023, its possible that investors may book profits and shift to large caps.

One more data point that is worth noting here with respect to small and midcap index is the monthly RSI levels. Refer the chart below.

Monthly RSI above 80 has been a good signal in the past for medium term top (refer circled dates on chart above). The current RSI is ~80.5. It was only during 2003-07 bull market that RSI remained elevated for extended period of time but even then index went to some corrections of more than 10% (Dec’03 and Apr’06 before making ultimate top in Jan’08).

While RSI is signalling caution, price action is not confirming. We may see some increased volatility going forward in mid and small cap. A break of 20 dma may indicate some sort of near term of top and corrective phase. Valuation of most mid and small caps stock is not favorable and we should wait for some correction to allocate fresh money in mid and smallcaps.

Bottom line from above analysis is that its prudent to protect gains made in mid and small caps in 2023 and shift to large caps where there is some comfort in valuation etc.

Sectors to watch out for in 2024

Now that we have made some assessment of how the front line indices is going to play out, let’s now look at sectors which may possibly do well in 2024 .

One of the biggest global macro events this year that market participants would be watching out is the rate cut cycle (specially by US federal reserve). While there is lot of hope and anticipation of higher rate cuts, if the actual move doesn’t happen as anticipated, there could be some sharp corrections. A rate cut by US Feds generally works well for emerging markets. Therefore we may see continuation of FIIs flow in 2024. With this backdrop FIIs preferred sectors like Banks and Financial services and IT may do well.

On the domestic front, as RBI also start cutting rates, rate sensitives sectors like Real estate ,(including building materials) Autos (including Auto ancilliary) will continue to do well. As inflation situation eases out we may also see revival in consumption (specially in rural areas) and QSR companies like Jubilant Foodworks, Devyani etc may get investors attention.

Dark Horse of 2024: Chemical companies can be the dark horse of 2024. The sector has gone through 2 years of bear market. While stock price appears to have bottomed out, earnings growth still awaited. With favorable valuation, the sector is offering low risk and potentially higher reward for long term investors. Companies focus on EV chemical space and specialty chemicals should be a preferred bet.

Will the PSU Rally continue ?

PSU banks still looking quite reasonable. Nifty PSU bank index is still trading at 1.3x price to book. Hence, valuation is still not expensive and with favorable earnings cycle and healthy asset quality, this sector may do well in 2024.

However, other PSU stocks from defence, rail etc are not offering any valuation comfort and therefore they may take a pause. Consolidation or even correction is quite possible. The stocks which have rallied on the back of order book news may see some reality check.

The chart above is the monthly chart of Nifty PSE. Monthly RSI of Nifty PSE is ~89 which is too extended. Hence, risk reward is not favorable. If you have these stocks in portfolio, continue to ride but one should wait for putting fresh money.

Infrastructure – Bull run may continue

Nifty Infra index witnessed a 15 year long breakout. Such multi-year breakouts do see follow through. This sector may also do well in 2024.

Conclusion

Despite a stellar rally in 2023, Nifty and many large-cap valuations are still reasonable, and this part of the market may perform relatively better. Small and mid-caps may take a pause or even correct. On the macro front, India is experiencing healthy GST collections. The RBI has also raised its GDP growth forecasts, which is a positive sign. On the global macro front, most investors are not pricing in any recession in the US. Any change in the US economic outlook may impact global markets. While the markets have digested and moved on from the impact of the ongoing wars (Russia-Ukraine war and Israel-Hamas War), these geopolitical factors may affect global growth.

Except for the valuation and exuberance in the small-cap, mid-cap, and SME segments, things are evenly balanced. However, the real risk is often unknown. As Morgan Housel (author of “The Psychology of Money” and “Same as Ever”) writes, ‘The biggest risk is what no one sees coming because if no one sees it coming, no one’s prepared for it, and if no one’s prepared for it, its damage will be amplified when it arrives.’

Financial markets, in the past, have surprised everyone, and they will continue to do so in the future. They go through periods of extreme euphoria and pessimism. Greed and fear are human emotions that never change. Therefore, the best way to navigate through all of this and grow your wealth is to have the right strategy and process in place and adhere to it in a disciplined manner. Looking forward to a great 2024 for all equity investors.