The technology sector had a rough time in 2022. While the Nifty 50 index returned ~ 4%, the Nifty IT index took a serious hit, plummeting by ~19% during the same period. The mid and small cap IT companies have witnessed much larger price damage.

Now that the Q3FY23 earning season has ended, we decided to take a look at how some of the midcap IT companies performed during that period and what their future outlooks are like. We picked Tata Elxsi, Coforge, Persistent Systems, LTTS, and KPIT for our analysis.

The table below summarizes the revenue growth for these companies.

Note: Q-o-Q (latest) means change in revenue in Q3FY23 over Q2FY23; Similarly, Q-O-Q (Previous) means change in revenue in Q2FY23 over Q1FY23; growth calculation based on rupee earnings and not in constant currency.

- Despite Q3 being a seasonally weak quarter, all companies have managed to achieve decent quarterly growth. KPIT was a standout, with quarterly revenue growth of approximately 23%.

- On an annual basis, most companies have posted healthy top-line growth, with Persistent and KPIT being the outliers with a revenue growth of about 45% and 47%, respectively.

- While margins have been a concern for most IT companies, all companies have seen a sequential improvement in margins during this quarter. This is an encouraging sign, especially since most companies experienced a decline in their margins during Q2FY23. Only Coforge and Tata Elxsi did not see an improvement in margins year-on-year, while others saw an improvement.

- Persistent has shown impressive improvement in its margin profile both quarterly and annually.

Profit Growth and Valuation

There has been a significant improvement in profit growth this quarter compared to the previous quarter, with a median profit growth of around 9.9%, in contrast to the 3.5% growth seen in the previous quarter.

Thanks to the price correction, these companies are now valued at a much more reasonable level, and their valuation multiples are hovering around the historical 5-year median. In terms of price performance, Persistent and KPIT have been the stars of the pack. Please note that Coforge’s profit increased significantly in Q2FY23(approximately 34%), primarily due to a rise in other income.

Business Update:

- The management of most companies has maintained a positive outlook for Q4FY23 and FY24 as issues around furloughs etc. are behind.

- Tata Elxsi’s transportation division is doing great, but their media and healthcare verticals are facing headwinds that may take another quarter or two to normalize, according to the management in their conference call.

- During their earnings call, LTTS management shared that they are experiencing strong demand in the “Transportation” and “Industrial Products” verticals. However, other verticals, such as “Telecom,” “Plant Engineering,” and “Telecom” remained subdued. Management remains optimistic and expects “Plant Engineering” to recover in Q4 FY23. They also announced 5 new deal wins and significant empanelment with Airbus, which are expected to support the company’s growth in the future.

- Coforge’s management has raised their revenue guidance for the year and indicated that EBITDA margin in Q4FY23 may improve over Q3FY23. The company signed one US$ 45 M+ contract in Europe and had strong deal wins momentum in Q3FY23.

- Persistent being a street favorite delivered strong quarterly performance. Q3 was a record high for the company in terms of TCV order wins. The total contract value for the quarter came in at $440.2 million, with new bookings TCV coming in at $239 million. Management has mentioned that their aspiration is to further improve EBITDA margin by 200-300 bps over medium term (2-3 year)

- Another street favorite, KPIT, reported impressive performance and raised their guidance for FY23 in the last quarter. The company won a total contract value of new engagements during Q3FY23, which stands at US$ 272 M (including a US$ 100 M engagement with Renault). Management is confident that they will exceed their guidance for the year.

Technical Setup

Tata Elxsi: Tata Elxsi led the IT bull market after the Covid crash but has now corrected ~30% from its peak. The stock is currently below the kumo cloud on the weekly time frame, so we suggest avoiding long positions. Valuation is still premium to its 5-year median. Waiting for another quarter may be a good idea

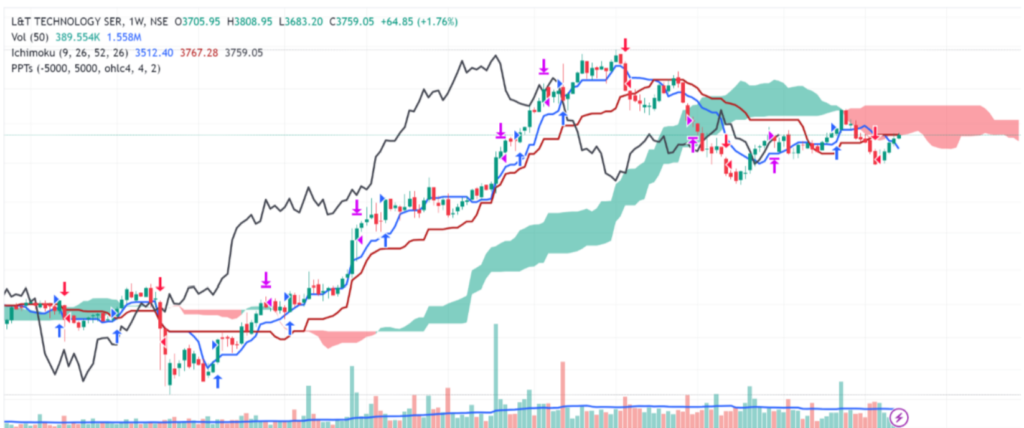

LTTS: The stock corrected significantly after the announcement of the SWC acquisition and is currently trading below the kumo cloud. The black line (also known as “Chikou” or “lagging span”) is trying to break out, indicating a potential bullish trend reversal. The valuation is still reasonable. If the sectoral trend continues, it could be a favorable bet with good risk-reward potential. It’s currently trading near its 40-week exponential moving average, and one may consider a long position once it moves past this level decisively,preferably on higher volume.

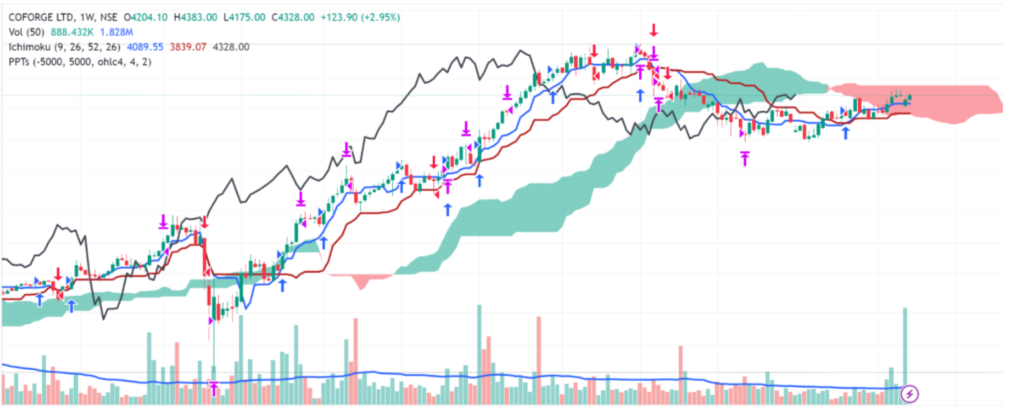

Coforge: Coforge probably has the best set up for fresh entry considering technical and fundamental parameters. As mentioned above, it’s currently trading near its 5-year median valuation multiple. Technically, price is above both base line (blue line) and conversion line (red line). Price is within kumo which is a neutral zone. Volume is also picking up (although a large part of it is because of a block deal that happened last week).

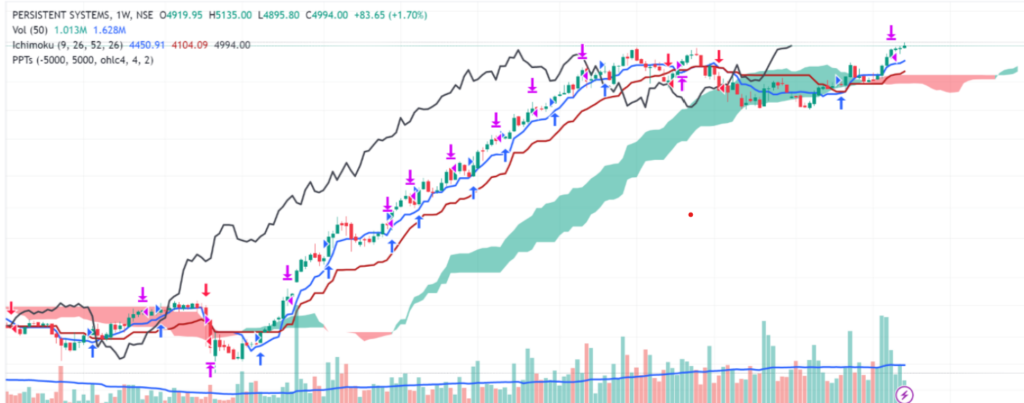

Persistent: Persistent is in a strong uptrend with stock recently closed above its all-time high. It is comfortably placed above all key Ichimoku components (i.e. kumo cloud, base line, conversion line). There has been a significant increase in volume in recent weeks signaling institutional interest. A good buy on dips candidate as there is more upside possible here.

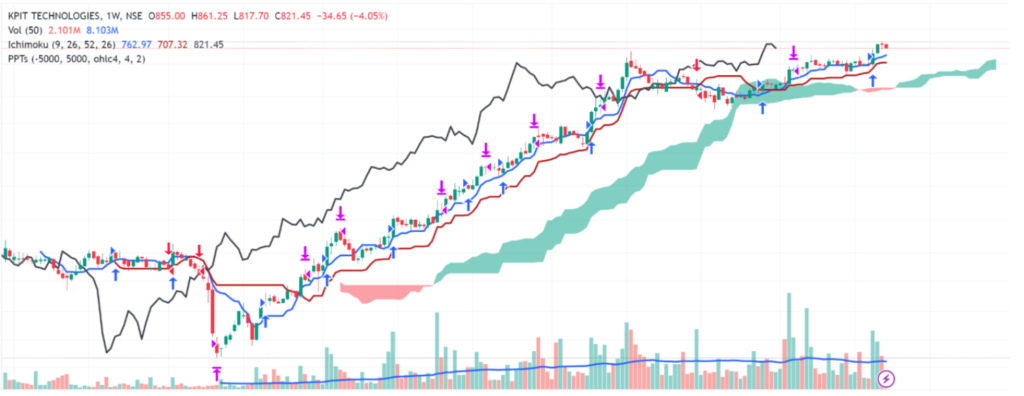

KPIT: Similar to Persistent, KPIT also crossed its all-time high on higher volume. While it is the most expensive of the 5 companies that we discussed, it is also the fastest growing among these 5 companies. It is also a proxy play on electric vehicles (EV) theme and therefore likely to trade at expensive valuation. One should use market correction to accumulate this as we expect uptrend to continue

Conclusion

The Q3 earnings expectations for IT companies were modest, but many of these companies have performed well and their management is optimistic about sustaining this momentum in Q4 and FY24. The performance of Indian IT companies is typically correlated with that of the NASDAQ, which has seen significant gains since start of 2023. However, the rise in bond yields in the US may potentially impact this trend. In the event of a correction in the NASDAQ, there may be a corresponding sell-off in Indian IT companies, which could potentially provide an opportunity to invest in these companies for the long-term, although it’s important to approach such investment decisions with caution.

Disclaimer: The above article is just for information and should not be considered as any investment advice. We may have positions in the companies mentioned or have advised our clients as part of our various services.