1. Overview and Purpose of SIF

The Securities and Exchange Board of India (SEBI) recently introduced Specialized Investment Funds (SIFs) as a new class of investment vehicle to bridge the gap between traditional mutual funds and higher-end products like Portfolio Management Services (PMS) and Alternative Investment Funds (AIFs). Announced in late 2024 and effective from April 1, 2025, SIFs are designed for experienced investors seeking more flexible, strategy-driven investments while still under strict regulatory oversight.

The goal is to offer sophisticated strategies in a regulated format so that investors do not have to resort to unregulated or unauthorized schemes. In essence, SIFs provide a “middle ground” – combining the accessibility and transparency of mutual funds with the customization and advanced strategies of PMS/AIFs

2. Key Features and Structure of SIFs

- Regulatory Framework: SIFs are governed under the SEBI (Mutual Funds) Regulations, 1996 (through recent amendments).Fund houses offering SIFs need to meet strict eligibility criteria. Established Asset Management Companies (AMCs) must have a track record of at least 3 years and ₹10,000 crore average assets under management (AUM) over the last three years Newer AMCs can qualify by hiring seasoned professionals – e.g. a Chief Investment Officer with 10+ years managing ₹5,000+ crore – to ensure experienced management. Importantly, SEBI requires SIFs to be branded separately from regular mutual funds to avoid investor confusion (distinct name, logo, and dedicated web pages). Fund house like Quant mutual fund, Edelweiss AMC etc have already received SEBI approval to launch SIF

- Investment Strategies and Flexibility: SIFs are allowed to pursue specialized investment strategies not typically available in normal mutual funds. Permitted schemes include long-short equity funds, sector-focused funds, long-short debt funds, and hybrid strategies with dynamic asset allocation. For example, an equity SIF can take up to 25% short positions via derivatives to benefit from downward moves – something regular funds generally cannot do. Each SIF scheme must stick to a single strategy category (equity, debt, or hybrid) to maintain focus. SIF portfolios can span multiple asset classes (equities, debt, REITs/InvITs, commodity derivatives, etc.), providing broader scope than traditional funds. At the same time, SEBI has built in risk controls: for instance, no more than 20% of the fund’s NAV can be in any one AAA-rated debt issuer (lower for lesser ratings), and only up to 25% of NAV per sector. SIFs may also take derivative exposure up to 25% of net assets for purposes other than hedging (i.e. for strategy/short bets). These limits keep risk concentrations in check while still allowing significant flexibility.

- Minimum Investment and Investor Profile: To ensure SIFs target sophisticated investors, SEBI has set a minimum investment threshold of ₹10 lakh per investor. This is a far higher entry bar than mutual funds (often ₹500–₹5,000), but much lower than PMS (₹50 lakh) or most AIFs (typically ₹1 crore). Notably, this ₹10 lakh minimum applies across all SIF schemes in an AMC at the investor’s PAN level, though accredited investors are exempt. Systematic Investment Plans (SIPs) and other periodic investment/withdrawal options are allowed in SIFs, but the minimum aggregate must be maintained. The higher entry requirement signals that SIFs are aimed at informed, affluent individuals comfortable with market risks.

- Liquidity and Redemption Structure: Unlike open-ended mutual funds that offer daily liquidity, SIFs can be structured as open-ended, close-ended, or interval funds with varying redemption frequencies. Some SIF strategies may allow daily or weekly redemptions, while others (especially debt or hybrid long-short funds) might permit redemptions only monthly or quarterly as disclosed in the offer document. SEBI permits notice periods of up to 15 working days for redemptions, giving fund managers leeway to manage less liquid positions. If a SIF is close-ended, its units must be listed on an exchange to provide an exit route for investors. In practice, SIF liquidity is moderate, more flexible than the multi-year lock-ins of some AIFs but not as on-demand as regular mutual funds

3. Comparing SIFs with AIFs and PMS

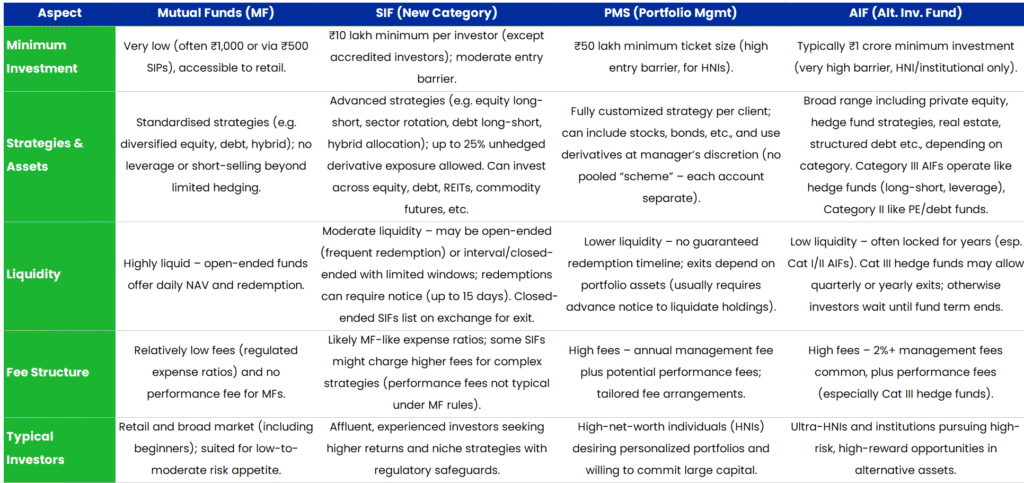

SIFs occupy a middle-ground niche between conventional mutual funds and the more exclusive PMS/AIF offerings. The table below highlights key differences:

4. Who Can Benefit from SIFs

- SIFs are expected to benefit affluent retail and semi-HNI investors who are comfortable with market volatility and seek more advanced investment strategies without committing ultra-large sums. This includes experienced individuals who find conventional mutual funds too limiting but are not ready or willing to invest ₹50 lakh+ in a PMS or ₹1+ crore in an AIF. Family offices and smaller institutional investors might also find SIFs attractive for niche strategies under a regulated fund format. By filling this gap, SIFs can help channel investor money into legitimate, professionally managed schemes rather than opaque alternatives.

- In the broader ecosystem, SIFs provide a new avenue for asset managers to innovate. Fund houses with strong research teams can now launch long-short equity funds, dynamic asset allocation funds, and other specialized products, thus preventing talent and capital from migrating entirely to AIFs or offshore hedge funds. SIFs could also foster competition and product diversity in the Indian market – for example, we are already seeing major AMCs launch dedicated SIF brands (e.g. Edelweiss’s Altiva SIF platform) to roll out innovative strategies. If managed prudently, SIFs have the potential to improve investor outcomes by offering higher-risk–higher-reward opportunities in a controlled setting.

5. Conclusion

In summary, SEBI’s Specialized Investment Fund framework is a significant development aimed at bridging a long-recognized gap. SIFs marks a transformative shift in India’s investment landscape offering a regulated, strategy-rich alternative for affluent investors seeking more than traditional mutual funds. By bridging the gap between retail products and high-ticket PMS/AIFs, SIFs empower a new class of investors with flexibility, innovation, and oversight in one package.

It remains to be seen what kind of strategies the fund houses launch and how they perform in the real market. Ultimately, the outcome will determine the long-term attractiveness of this asset class.