Introduction: Swiggy and Zomato Earnings in FY26

India’s food‑delivery market is shifting from food orders to quick commerce. Swiggy and Zomato (now listed as Eternal) are expanding aggressively into instant‑grocery delivery, dark stores and new customer propositions while still building scale in core food delivery. Both firms delivered strong top‑line growth in Q1 FY26, but profitability diverged as quick‑commerce investments weighed on results. This report compares the latest earnings of Swiggy and Zomato, reviews management outlook and discusses valuation and key catalysts.

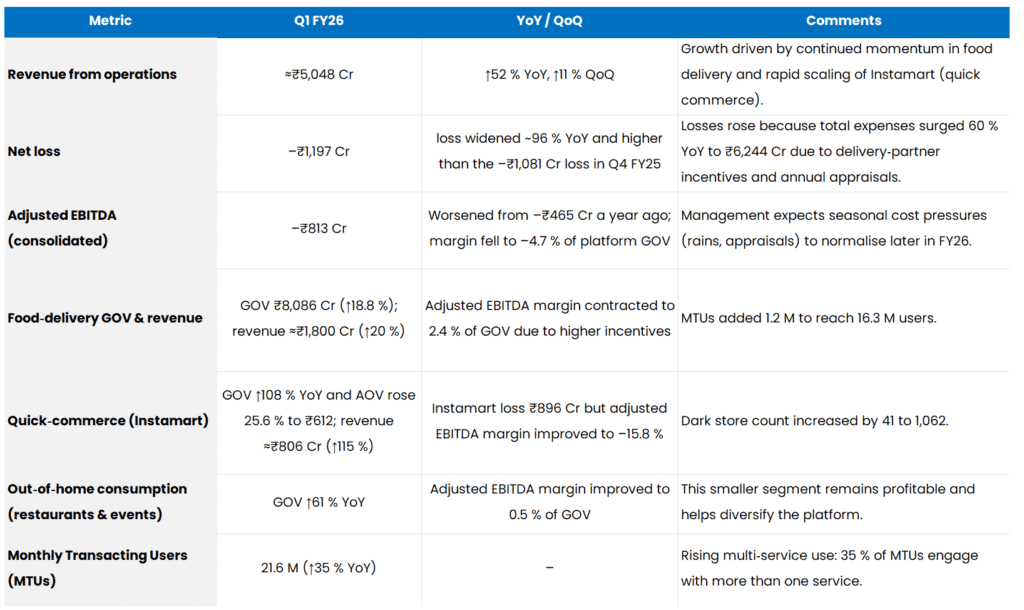

Swiggy Q1 FY26 Results Overview:

Management commentary and outlook.

Swiggy’s MD & CEO Sriharsha Majety said the food‑delivery business continues to grow robustly while the company launches new propositions such as Bolt and 99‑store to create incremental consumption. Instamart’s jump in AOV was attributed to assortment expansion and Maxxsaver adoption. Management is focusing on calibrated network expansion and increasing basket size to drive long‑term profitability.

Swiggy plans to divest its 12 % stake in Rapido (bike‑taxi start‑up) to strengthen liquidity. Management hasn’t provided a timeline but said more clarity will follow.

The company believes it has moved past the Q4 FY25 loss peak in quick commerce and will modulate investments to drive scale‑led profitability

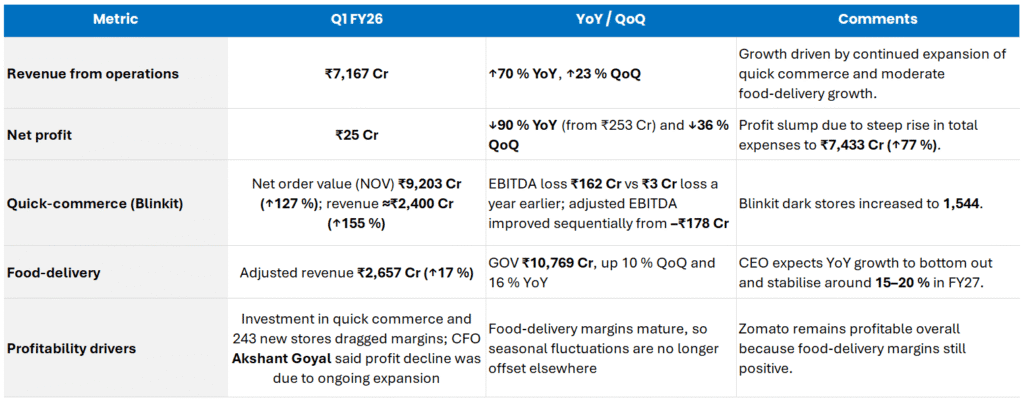

Zomato (Eternal) Q1 FY26 Results Overview

Management commentary and outlook.

Akshant Goyal (CFO) said profit decline was driven by continued investment in quick‑commerce infrastructure. He highlighted that quick‑commerce NOV growth 127 % YoY to ₹9,203 Cr means this segment has overtaken food‑delivery NOV.

CEO Deepinder Goyal noted that food‑delivery YoY growth should bottom out after the demand slowdown of late 2024. He expects FY26 growth north of 15 %, trending towards 20 % in FY27. Management remains focused on balancing growth and profitability in quick commerce

Comparative analysis

Revenue & growth

Top‑line momentum: Zomato outpaced Swiggy in revenue growth, posting 70 % YoY rise to ₹7,167 Cr versus Swiggy’s 52 % YoY increase to ₹5,048 Cr. Consequently, Zomato’s revenue base is ~1.4× larger.

Revenue mix: Swiggy’s revenue split is roughly 35 % food delivery (₹1,800 C) and 16 % Instamart (₹806 Cr), with the rest from other services. Zomato’s quick‑commerce revenue (~₹2,400 Cr) now exceeds its food‑delivery adjusted revenue (₹2,657 Cr) and is growing at 155 % YoY

User metrics: Swiggy’s platform MTUs rose 35 % to 21.6 M, indicating continued user acquisition. Zomato doesn’t disclose MTUs but GOV growth of its food business is lower (10 % QoQ and 16 % YoY), suggesting a more mature user base.

Profitability

Losses vs profitability: Swiggy posted a net loss of ₹1,197 Cr and an adjusted EBITDA margin of –4.7 %. Zomato remained profitable albeit with a 90 % drop in profit to ₹25 Cr

Segment drag: Both companies’ quick‑commerce arms are the largest drag on profitability. Instamart reported a –15.8 % adjusted EBITDA margin and loss of ₹896 Cr, while Blinkit recorded an EBITDA loss of ₹162 Cr even though its revenue grew 155 %. Blinkit’s loss is smaller because of larger scale and improved unit economics.

Strategic positioning

Quick‑commerce investment: Swiggy is modulating Instamart investment and expects losses to have peaked. It is also exploring the sale of its Rapido stake to shore up cash. Zomato is still ramping up Blinkit’s dark stores (1,544 stores) and management sees quick commerce as the next

Food‑delivery maturity: Zomato’s food‑delivery business appears mature with moderate GOV growth (10 % QoQ). Margins are stabilising but no longer offset seasonal pressure. Swiggy’s food‑delivery GOV growth (18.8 %) and MTU additions suggest more headroom; however, margins compressed to 2.4 % of GOV because of seasonal incentives.

Capital access: As a public company, Zomato has stronger access to capital markets and enjoys a higher market cap ($22.87 B), giving it more cushion to invest and weather losses. Swiggy’s market cap ($10.61 B) and P/S ratio (5.92–8.87) suggest investors price in significant growth but are wary of continuing losses

Valuation gap

Market capitalisation: Zomato’s market cap of $22.87 B (₹1.9 trn) is over 2× Swiggy’s $10.61 B (₹880 Bn). Yet Zomato’s quarterly revenue is only ~1.4× larger and its profit is a small ₹25 Cr.

Price‑to‑sales (P/S) multiples: Swiggy’s current P/S ratio is around 5.9, while Zomato trades at 12.0x. This suggests the market assigns a premium to Zomato for being listed and profitable despite Blinkit losses. Swiggy still attracts a relatively high multiple given its higher growth and potential listing.

Valuation drivers: Zomato’s higher multiple reflects greater scale, public‑market liquidity and near‑term profitability. Swiggy’s lower market cap could expand if (1) Instamart losses narrow, (2) a Rapido divestment bolsters cash and (3) the company signals a clear path to profitability.

Key triggers to watch for Swiggy

Quick‑commerce profitability. Instamart’s losses remain the largest drag. Monitoring AOV, basket‑size expansion and dark‑store productivity will indicate whether margins can improve from –15.8 % towards break‑even.

Rapido stake sale. Swiggy plans to sell its 12 % stake in Rapido to strengthen liquidity. The sale price and timing will influence cash reserves and investment capacity.

Bolt/99‑store uptake and new propositions. These initiatives aim to broaden addressable markets and drive incremental consumption. Adoption metrics and partner feedback will signal success.

Regulatory & competitive landscape. Intensifying competition from Zomato, Zepto and BigBasket in quick commerce could pressure pricing and margins. Additionally, any change in government policy on gig workers’ rights or dark‑store zoning could impact costs

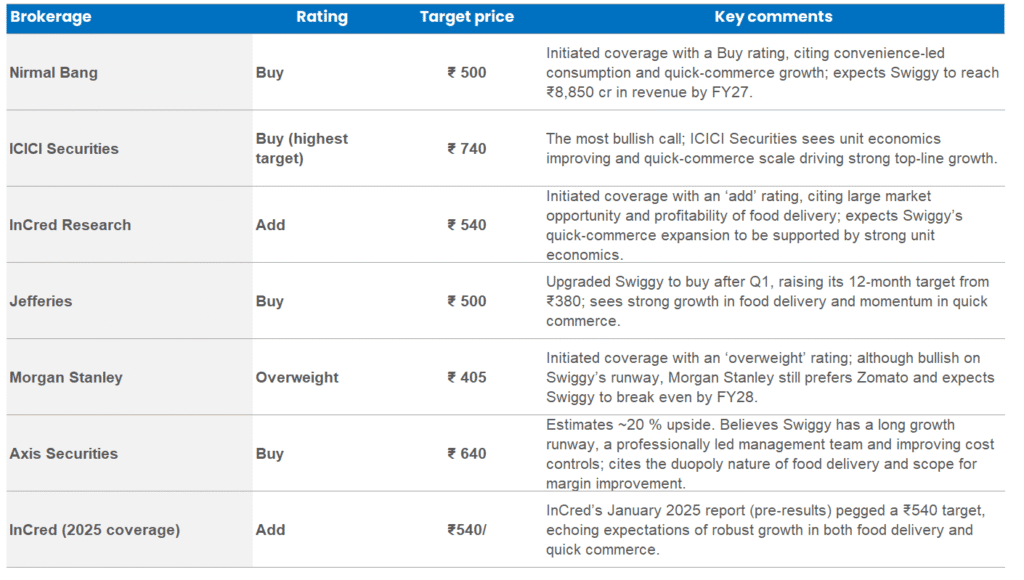

Brokerage consensus and target prices

Analysts reacted to the Q1 FY26 numbers by revising their price targets. The table below summarises the most recent sell‑side calls available in the public domain. Note: target prices reflect analyst estimates, not guarantees of future performance.

Swiggy is currently trading at approximately ₹392. Based on six brokerage targets, the average target price stands at ₹554, while the median is ₹520. This suggests an upside potential of 32% to 41% from current levels.

In contrast, Zomato’s consensus target prices average around ₹292, with a median of ₹315. With the stock trading at ₹304, it appears to be fairly valued at present.

Conclusion

Swiggy delivered strong revenue growth in Q1 FY26 but remains deep in the red due to heavy investment in delivery partner incentives and quick‑commerce expansion. Management sees this as seasonal and expects margins to normalise later in the year while continuing to bet on Instamart and new propositions like Bolt and 99‑store. The planned Rapido stake sale may provide additional capital.

Zomato, rebranded as Eternal, recorded a 70 % surge in revenue but saw profit collapse due to aggressive Blinkit expansion. Still, it stayed marginally profitable and enjoys greater scale, stronger liquidity and a public‑market premium. Zomato’s management expects food‑delivery growth to stabilise around 15–20 % YoY, while Blinkit remains the key variable.

The competitive landscape suggests that quick commerce will be the battleground. Swiggy’s valuation discount versus Zomato partly reflects its heavier losses. Narrowing the gap requires demonstrating a credible path to profitability, successfully divesting non‑core assets, and possibly tapping the public markets.

Disclaimer::This research note is issued solely for educational and informational purposes. It does not constitute investment advice or a solicitation to buy, sell or hold any security. Readers should assess their own risk appetite and consult their SEBI‑registered investment advisor before acting on any information herein. Coinstreet and its affiliates may, from time to time, have positions in the securities discussed or may have provided advisory services to clients regarding them. While every effort is made to ensure accuracy, no representation or warranty, express or implied, is given as to the completeness or reliability of the information