Small Cap stocks had a dream run post the covid crash in Mar’ 2020. However, after reaching its peak in October 2021, the small-cap index underwent a significant correction. Recently, in March 2023, small-cap stocks hit their lows and have since been staging a comeback. What sets this rally apart from the one in 2022 is its broad-based nature, with breakout performances observed across various segments.

In this blog, we will explore the world of small-cap stocks. We have carefully selected five stocks that meet our fundamental criteria, offering reasonable valuations and attractive risk-reward profiles from a technical standpoint. It’s important to note that our “top Small cap ideas” are chosen with a long-term investment perspective rather than short-term trading. Investing in small-cap companies carries inherent risks, but it can also present rewarding opportunities.

Before we proceed, please be aware that these ideas do not constitute our buy recommendations. We may have provided similar suggestions as part of our advisory services or have our own positions in these stocks. If you are interested in accessing our recommendation list, we invite you to subscribe to our advisory services.

Methodology:

The methodology that we have followed to shortlist the top 5 small cap investment ideas is as follows

- Market Capitalization less than INR 10,000 crores

- Company must have high ROE and ROCE preferably above 20%

- Must be profitable in last 3 years

- Minimal debt or debt free companies

- No promoter pledged

- Stable or Improving Operating Margins

- Reasonable valuation – We use different valuation ratios for companies in different sectors and compare evaluate them based on the company’s business economies and operating metrics.

- High Cash conversion ratio and positive free cash flows in the last 2 out of 3 years.

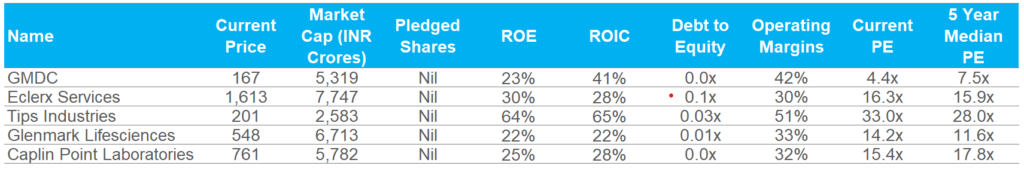

Finally, after filtering companies based on the above factors, we looked at the technical structure of the shortlisted companies and have finalized 5 names where we have valuation comfort and felt the trend is reversing and the stock is offering good risk-reward from long term perspective.

A brief overview about these companies is provided in the following paragraph

GMDC (Gujarat Mineral Development Corporation)

First on the list of top 5 small cap stock ideas is GMDC. GMDC is a prominent public sector enterprise owned by the Gujarat government. The company specializes in the mining and marketing of industrial minerals within the state. With over six decades of experience in the mining and minerals sector, GMDC has established itself as a key player in Gujarat’s mineral resources industry.

As India’s largest merchant seller of lignite and the second-largest lignite-producing company in the country, GMDC holds a significant position in the market. Lignite mining serves as the primary source of revenue for the company, contributing around 85-90% of its total income from operations. GMDC plays a crucial role in meeting approximately 25% of Gujarat’s lignite demand, and it has set targets to further increase its market share to 30-35% by FY25.

Given GMDC’s strong balance sheet, its current valuation of ~4.4x looks attractive. The company currently offers a dividend yield of approximately 2.45%, provides additional comfort. With the growing attention towards public sector undertaking (PSU) companies among investors, GMDC presents an interesting stock to monitor going forward.

Eclerx Services

Next up on the list is eClerx Services India Limited. eClerx Services India Limited is a prominent global provider of business process management (BPM) and data analytics solutions. With its headquarters in Mumbai, India, the company adopts a client-centric approach and caters to a diverse range of industries. eClerx offers comprehensive services designed to meet the evolving needs of businesses in today’s competitive landscape.

In terms of financial performance, eClerx reported favorable results for the quarter ending March 2023. While the operating margin expanded sequentially during Q4FY23, it remained slightly lower compared to the same period last year (March 2022). The company anticipates some softness in demand in the short term; however, it aspires to achieve double-digit growth over the medium to long term.

From a valuation perspective, the stock is reasonably priced. Notably, the promoters, foreign institutional investors (FIIs), and domestic institutional investors (DIIs) have all increased their shareholding in the last quarter (March 2023). This is an encouraging sign that highlights the confidence of key stakeholders in the company’s prospects.

Furthermore, there has been a recent breakout of the stock from the Ichimoku cloud on the weekly timeframe, indicating a potential long-term trend reversal. This technical indicator, combined with positive developments in financial performance and increased shareholding, further supports the investment case for eClerx.

TIPS Industries Limited

Tips Industries Limited is the third company on our list of top 5 small-cap stocks. Established in 1996, Tips Industries operates in the production and distribution of motion pictures, as well as the acquisition and exploitation of music rights. The company possesses an extensive music library, boasting a collection of over 29,000 songs spanning various genres and major regional languages.

Tips Industries has demonstrated strong financial performance, with an impressive operating margin of approximately 51%. Additionally, the company exhibits robust returns on equity (ROE) and return on invested capital (ROIC) at around 64% and 65%, respectively. These figures indicate efficient utilization of resources and solid profitability.

Recently, Tips Industries completed the demerger of its film production division, separating it into a separate entity called Tips Films Limited. This move aimed to streamline operations and optimize the balance sheet. The management has provided growth guidance, targeting a 30% increase in revenues and profit after tax (PAT) for FY24, with a similar growth trajectory expected to continue for the next 2-3 years.

Considering the company’s favorable fundamentals, growth guidance, and the completion of the demerger, the stock is currently trading at reasonable valuation.

Glenmark Lifesciences

Next up on the list is a pharmaceutical company i.e Glenmark Lifesciences (GLS). GLS is a renowned pharmaceutical company specializing in the manufacturing of high-quality active pharmaceutical ingredients (APIs) and intermediates. As a subsidiary of Glenmark Pharmaceuticals Ltd, GLS has established itself as a leading player in the API segment, catering to the global pharmaceutical industry.

GLS boasts a diverse product portfolio, focusing on APIs for various therapeutic areas such as cardiovascular disease, central nervous system disorders, pain management, and diabetes. The company’s offerings meet stringent quality standards and cater to the growing demand for reliable pharmaceutical ingredients.

In addition to APIs, GLS provides research and manufacturing services to pharmaceutical companies worldwide. Its Contract Development and Manufacturing Operations (CDMO) segment contributes to the company’s revenue generation, along with its core business of generics and complex APIs.

Since its listing in 2021, GLS’s stock performance has been on a downtrend, underperforming the benchmark indices. However, in recent months, the share price has shown a steady upward trend. Notably, the company reported excellent financial results for the quarter ending March 2023, with good revenue growth both on a quarterly and yearly basis.

Operating margins have also improved, expanding to 33% in March 2023 compared to approximately 27% in December 2022 and 28% in March 2022. This positive trend in financial performance, if sustained, has the potential to result in a rerating of the stock.

With a current valuation of approximately 14.0x based on the last 12 months’ earnings, GLS is reasonably priced. From a technical standpoint, the stock is in an uptrend, with both short-term and long-term moving averages trending upward. This indicates positive momentum and market sentiment.

Caplin Point Laboratories

Caplin Point Laboratories Limited (CPLL) is the final company on our list of top 5 small-cap stock ideas. CPLL is an India-based pharmaceutical company that specializes in producing, developing, and marketing a wide range of generic formulations and branded products. The company exports its products to overseas markets, showcasing its global reach and market presence.

CPLL’s product portfolio encompasses tablets, dry syrups, soft gels, capsules, suppositories, liquid syrups, injectables, ophthalmic droppers, pre-mix bags, topicals, and sachets, including ointments, creams, gels, and lotions. The company caters to various healthcare needs with its diverse offerings.

In terms of geographical presence, CPLL has established a strong foothold in Latin America (LATAM), Southern Africa, Francophone Africa, the United States of America, and the European region. This global presence highlights its ability to tap into multiple markets and expand its customer base.

From a valuation perspective, the stock is currently trading below its 5-year median valuation, indicating potential value for investors. Furthermore, the promoters have increased their holdings in the current quarter, which can be seen as a positive signal regarding the company’s prospects.

Technically, the stock has been exhibiting an upward trend since the first week of April 2023. Recently, it closed above the ichimoku cloud on the weekly timeframe, indicating a potential trend reversal. This technical indicator, combined with the stock’s comfortable valuation and strong fundamentals, presents a favorable risk-reward scenario for considering a long position.

Summary

Investing in small-cap stocks can be both risky and rewarding. In this article, we aim to provide you with a list of small-cap companies that exhibit promising characteristics such as attractive valuations, improving earnings, and positive chart trends. It is important to note that these suggestions do not constitute buying recommendations. Before making any investment decisions, we strongly advise conducting your own thorough due diligence. We welcome any queries or suggestions you may have, so please feel free to share them in the comment box.